Aswath Damodaran, a Professor of Finance at the Stern School of Business, has an interesting post on his blog Musings on Markets, Transaction costs and beating the market. Damodaran’s thesis is that transaction costs – broadly defined to include brokerage commissions, spread and the “price impact” of trading (which I believe is an important issue for some strategies) – foil in the real world investment strategies that beat the market in back-tests. He argues that transaction costs are also the reason why the “average active portfolio manager” underperforms the index by about 1% to 1.5%. I agree with Damodaran. The long-term, successful practical application of any investment strategy is difficult, and is made more so by all of the frictional costs that the investor encounters. That said, I see no reason why a systematic application of some value-based investment strategies should not outperform the market even after taking into account those transaction costs and taxes. That’s a bold statement, and requires in support the production of equally extraordinary evidence, which I do not possess. Regardless, here’s my take on Damodaran’s article.

First, Damodaran makes the point that even well-researched, back-tested, market-beating strategies underperform in practice:

Most of these beat-the-market approaches, and especially the well researched ones, are backed up by evidence from back testing, where the approach is tried on historical data and found to deliver “excess returns”. Ergo, a money making strategy is born.. books are written.. mutual funds are created.

…

The average active portfolio manager, who I assume is the primary user of these can’t-miss strategies does not beat the market and delivers about 1-1.5% less than the index. That number has remained surprisingly stable over the last four decades and has persisted through bull and bear markets. Worse, this under performance cannot be attributed to “bad” portfolio mangers who drag the average down, since there is very little consistency in performance. Winners this year are just as likely to be losers next year…

Then he explains why he believes market-beating strategies that work on paper fail in the real world. The answer? Transaction costs:

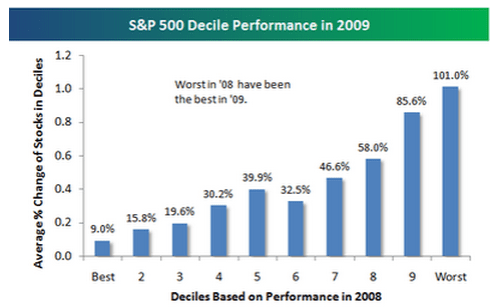

So, why do portfolios that perform so well in back testing not deliver results in real time? The biggest culprit, in my view, is transactions costs, defined to include not only the commission and brokerage costs but two more significant costs – the spread between the bid price and the ask price and the price impact you have when you trade. The strategies that seem to do best on paper also expose you the most to these costs. Consider one simple example: Stocks that have lost the most of the previous year seem to generate much better returns over the following five years than stocks have done the best. This “loser” stock strategy was first listed in the academic literature in the mid-1980s and greeted as vindication by contrarians. Later analysis showed, though, that almost all of the excess returns from this strategy come from stocks that have dropped to below a dollar (the biggest losing stocks are often susceptible to this problem). The bid-ask spread on these stocks, as a percentage of the stock price, is huge (20-25%) and the illiquidity can also cause large price changes on trading – you push the price up as you buy and the price down as you sell. Removing these stocks from your portfolio eliminated almost all of the excess returns.

In support of his thesis, Damodaran gives the example of Value Line and its mutual funds:

In perhaps the most telling example of slips between the cup and lip, Value Line, the data and investment services firm, got great press when Fischer Black, noted academic and believer in efficient markets, did a study where he indicated that buying stocks ranked 1 in the Value Line timeliness indicator would beat the market. Value Line, believing its own hype, decided to start mutual funds that would invest in its best ranking stocks. During the years that the funds have been in existence, the actual funds have underperformed the Value Line hypothetical fund (which is what it uses for its graphs) significantly.

Damodaran’s argument is particularly interesting to me in the context of my recent series of posts on quantitative value investing. For those new to the site, my argument is that a systematic application of the deep value methodologies like Benjamin Graham’s liquidation strategy (for example, as applied in Oppenheimer’s Ben Graham’s Net Current Asset Values: A Performance Update) or a low price-to-book strategy (as described in Lakonishok, Shleifer, and Vishny’s Contrarian Investment, Extrapolation and Risk) can lead to exceptional long-term investment returns in a fund.

When Damodaran refers to “the price impact you have when you trade” he highlights a very important reason why a strategy in practice will underperform its theoretical results. As I noted in my conclusion to Intuition and the quantitative value investor:

The challenge is making the sample mean (the portfolio return) match the population mean (the screen). As we will see, the real world application of the quantitative approach is not as straight-forward as we might initially expect because the act of buying (selling) interferes with the model.

A strategy in practice will underperform its theoretical results for two reasons:

- The strategy in back test doesn’t have to deal with what I call the “friction” it encounters in the real world. I define “friction” as brokerage, spread and tax, all of which take a mighty bite out of performance. These are two of Damodaran’s transaction costs and another – tax. Arguably spread is the most difficult to prospectively factor into a model. One can account for brokerage and tax in the model, but spread is always going to be unknowable before the event.

- The act of buying or selling interferes with the market (I think it’s a Schrodinger’s cat-like paradox, but then I don’t understand quantum superpositions). This is best illustrated at the micro end of the market. Those of us who traffic in the Graham sub-liquidation value boat trash learn to live with wide spreads and a lack of liquidity. We use limit orders and sit on the bid (ask) until we get filled. No-one is buying (selling) “at the market,” because, for the most part, there ain’t no market until we get on the bid (ask). When we do manage to consummate a transaction, we’re affecting the price. We’re doing our little part to return it to its underlying value, such is the wonderful phenomenon of value investing mean reversion in action. The back-test / paper-traded strategy doesn’t have to account for the effect its own buying or selling has on the market, and so should perform better in theory than it does in practice.

If ever the real-world application of an investment strategy should underperform its theoretical results, Graham liquidation value is where I would expect it to happen. The wide spreads and lack of liquidity mean that even a small, individual investor will likely underperform the back-test results. Note, however, that it does not necessarily follow that the Graham liquidation value strategy will underperform the market, just the model. I continue to believe that a systematic application of Graham’s strategy will beat the market in practice.

I have one small quibble with Damodaran’s otherwise well-argued piece. He writes:

The average active portfolio manager, who I assume is the primary user of these can’t-miss strategies does not beat the market and delivers about 1-1.5% less than the index.

There’s a little rhetorical sleight of hand in this statement (which I’m guilty of on occasion in my haste to get a post finished). Evidence that the “average active portfolio manager” does not beat the market is not evidence that these strategies don’t beat the market in practice. I’d argue that the “average active portfolio manager” is not using these strategies. I don’t really know what they’re doing, but I’d guess the institutional imperative calls for them to hug the index and over- or under-weight particular industries, sectors or companies on the basis of a story (“Green is the new black,” “China will consume us back to the boom,” “house prices never go down,” “the new dot com economy will destroy the old bricks-and-mortar economy” etc). Yes, most portfolio managers underperform the index in the order of 1% to 1.5%, but I think they do so because they are, in essence, buying the index and extracting from the index’s performance their own fees and other transaction costs. They are not using the various strategies identified in the academic or popular literature. That small point aside, I think the remainder of the article is excellent.

In conclusion, I agree with Damodaran’s thesis that transaction costs in the form of brokerage commissions, spread and the “price impact” of trading make many apparently successful back-tested strategies unusable in the real world. I believe that the results of any strategy’s application in practice will underperform its theoretical results because of friction and the paradox of Schrodinger’s cat’s brokerage account. That said, I still see no reason why a systematic application of Graham’s liquidation value strategy or LSV’s low price-to-book value strategy can’t outperform the market even after taking into account these frictional costs and, in particular, wide spreads.

Hat tip to the Ox.