Lamassu Holdings LLC has nominated two director candidates for election to the Ditech Networks Inc (NASDAQ:DITC) board of directors at the DITC annual meeting.

We’ve been following DITC (see our archive here) because it is trading below its net cash value with an investor, Lamassu Holdings LLC, disclosing a 9.4% holding in November last year. Lamassu has previously offered to acquire DITC for $1.25 per share in cash. Lamassu says that it “anticipates its due diligence requirement will take no more than two weeks and there is no financing contingency.” Lamassu has now nominated two candidates for election to the board “who are committed to enhancing shareholder value through a review of the Company’s business and strategic direction.” The stock is up 16.8% from $0.89 to close yesterday at $1.04, giving the company a market capitalization of $27.3M. We last estimated the net cash value to be $34.3M or $1.31 per share.

Here’s the announcement from Lamassu Holdings:

Lamassu Holdings L.L.C. Discloses Nomination of Two Highly Qualified Director Candidates for Election to the Ditech Networks Board of Directors at the 2009 Annual Meeting

NEWPORT BEACH, Calif.–(BUSINESS WIRE)–Lamassu Holdings L.L.C. (“Lamassu”) announced today that it has nominated two highly qualified director nominees for election to the Board of Directors (the “Board”) of Ditech Networks, Inc. (the “Company” or “DITC”) (Nasdaq:DITC) to replace two directors whose terms are up for election at the Company’s 2009 Annual Meeting of Stockholders (the “Annual Meeting”). Lamassu, which beneficially owns an aggregate of 2,399,845 shares, or approximately 9.1% of the outstanding shares of common stock of the Company, delivered written notice today of its nominations to the Corporate Secretary of the Company in accordance with the Company’s bylaws.

Tim Leehealey, managing member of Lamassu and one of Lamassu’s director nominees, stated, “After repeated attempts to engage in a constructive dialogue were ignored by the incumbent Board and AccessData’s interest in purchasing the Company at a significant premium was rejected without any discussions with the potential bidder, we have come to the conclusion that new leadership on the Board is needed to maximize stockholder value, which we believe has suffered significant deterioration at the hands of the current Board.”

Mr. Leehealey continued, “We believe the current regime has a strong track record of failure in allocating the Company’s capital. Whether embarking on organic product development or growth through acquisition, this Board has failed to diversify outside of its core echo cancellation product line. We believe all significant efforts to diversify, including its Titanium systems, the Packet Voice Processor platform and acquisition of Jasomi Networks, Inc., have cost the company well over $100 million in capital and, quite possibly, closer to $200 million, even as the Company generated significant cash from its core echo business. Now the Company is faced with reinventing its business and it appears the current Board, which has failed miserably in its prior attempts to do so, believes that stockholders want a course of action that includes internally pursing another high-risk product strategy as well as pursuing acquisition opportunities.”

Mr. Leehealey concluded, “We are fearful that stockholder equity will continue to erode at the Company unless substantial changes are made. To this end we are nominating two highly qualified directors who are committed to enhancing shareholder value through a review of the Company’s business and strategic direction. If elected, our nominees intend to work constructively with the remaining Board members, as well as with the Company’s management team, to determine the best course of action for stockholders. Our nominees intend to conduct a strategic review of all options for the Company, including a possible sale or liquidation, that will improve stockholder value without taking undo risk that could jeopardize the remaining value inherent in the Company’s balance sheet, something we believe this Board has failed to accomplish.”

Stockholders can refer to Lamassu’s previous SEC filings for additional information.

The Company currently has a total of seven directors. Lamassu is seeking to replace two incumbent directors whose terms of office expire at the Annual Meeting.

Lamassu’s two independent director nominees will bring substantial business leadership and corporate governance expertise to the Company’s Board. The nominees are:

* Tim Leehealey. Mr. Leehealey is the co-founder and managing member of Lamassu Holdings L.L.C., a holding company specializing in taking an active role in small technology and alternative energy investments. In addition to his position with Lamassu, Mr. Leehealey is CEO of AccessData, a Lamassu company and provider of investigative software focused in the areas of forensics, eDiscovery, and incident response. Mr. Leehealey joined AccessData in August of 2007 and under his leadership has more than doubled the size of the company and established it as one of the leading providers in its market. Prior to joining AccessData, Mr. Leehealey was with Guidance Software for four years, as the Vice President of Corporate Development, and played a key role in taking that company public in 2006. In addition to his work at Guidance Software and AccessData, Mr Leehealey spent approximately 10 years working as an equity analyst covering security and networking companies. Mr. Leehealey holds a degree in computer science and economics from Stanford University.

* Frank J. Sansone. Mr. Sansone has over 15 years of financial management and technology experience with a focus on managing all the financial elements of small fast growing public and private technology companies. Most recently Mr. Sansone served as CFO for LiveOffice, a rapidly growing SAAS email archiving software & services company with annual revenues of approximately $25 million with 96% annual bookings growth and 100+ employees. Prior to his involvement with LiveOffice Mr. Sansone served as the CFO of Guidance Software were he not only was instrumental in helping to deliver over 5 years of 40%+ growth but he also oversaw all the key financial aspects associated with taking the company public. Before joining Guidance Software Mr. Sansone accumulated approximately 10 years of financial experience including working for five years as a Audit Manager at PricewaterhouseCoopers. Mr. Sansone is a CPA in good standing with both the California Society of Certified Public Accountants as well as the American Institute of Certified Public Accountants.

[Full Disclosure: We do not have a holding in DITC. This is neither a recommendation to buy or sell any securities. All information provided believed to be reliable and presented for information purposes only. Do your own research before investing in any security.]

Read Full Post »

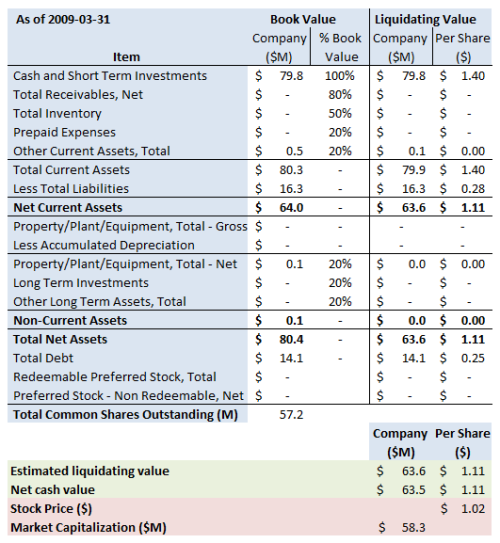

Balance sheet adjustments

Balance sheet adjustments CRGN’s $79.8M in cash and short term investments consists of $45.6M in cash and equivalents, $18.0M in short-term investments and $16.1M in marketable securities.

CRGN’s $79.8M in cash and short term investments consists of $45.6M in cash and equivalents, $18.0M in short-term investments and $16.1M in marketable securities.