Amit Chokshi of Kinnaras Capital, an independent registered investment advisor focused on deep-value, small capitalization and micro capitalization equity investing, has contributed a guest post on Imation Corp (NYSE:IMN).

About Kinnaras:

Kinnaras aims to deliver above average long-term results through application of a deep value investment strategy. As a result, the Firm focuses on the “throwaways” of the equity market, or stocks that are generally viewed as broken from a fundamental standpoint. The Firm utilizes a fundamental, bottom-up, research-intensive approach to security selection, focusing mainly on prospects trading below book and/or tangible book value or cheap price to free cash flow. Kinnaras is a strong advocate of mean reversion and has found that pessimistic valuations, and thus attractive investment opportunities, often manifest when the broader investment community disregards mean reversion and impounds overly pessimistic expectations into security prices. When valuation incorporates these pessimistic assumptions, the risk/reward scenario favors the investor.

Imation Worth More Sold Than Alone

As a deep value investor, one is always confronted with companies that have potentially great assets but can be overshadowed by poor management. As a deep value investor, often times a great stock is not necessarily a great company but the overall value available from an investment standpoint is too attractive to pass up. Based on its current valuation, IMN appears to fall into this category.

IMN is a global developer and marketer of branded storage/recording products focused on optical media, magnetic tape media, flash and hard drive products and consumer electronic products. The company has significant global scale and its brand portfolio includes the Imation, Memorex, and XtremeMac brands. The company is also the exclusive licensee of the TDK Life on Record brand.

IMN has high brand recognition and is a leader in its key categories of optical and magnetic tape media. While the company faces long term secular challenges with regards to how data is stored, the current valuation appears to be highly muted due to a number of strategic and capital allocation blunders over the company’s past 5+ years. Management would be doing shareholders a greater service by simply putting the company up for sale given the time allotted for a number of strategic moves to play out unsuccessfully in recent years. Moreover, IMN has been on an acquisition spree in 2011 and existing shareholders may see further value destruction given the track record of management. The following highlights some key grievances shareholders should have with IMN’s current strategy

Horrific Capital Allocation by Management: IMN’s cash balance serves as somewhat of a fundamental backstop against permanent capital loss. The problem, however, is that the company’s net cash balance has been used to fund a number of bad decisions, particularly M&A. Management has acquired a number of businesses in recent years, none of which have benefited shareholders. These acquisitions of businesses and intellectual property (“IP”) have led to clear value destruction as evidenced by IMN’s sales and operating income performance since those acquisitions along with on going write-offs of goodwill tied to a number of those purchases and constant restructuring charges eating into book equity.

One example of how poor management’s acquisition strategy was its purchase of BeCompliant Corporation (Encryptx) on February 28, 2011 which resulted in $1.6MM in goodwill. In less than five weeks, IMN had determined the goodwill tied to this acquisition to be fully impaired! While $1.6MM is a tiny amount, Table I highlights the total value of goodwill written off by IMN in recent years along with the ongoing restructuring charges in the context of the company’s historical acquisition capex.

TABLE I: IMN ACQUISITION CAPEX & IMPAIRMENT, RESTRUCTURING CHARGES ($MM) [Click to expand]

Since 2006, IMN management has deployed $442MM in cash to acquire a variety of businesses. Since that time, investors have had to experience $152MM in goodwill write-offs and another $169MM in restructuring charges as IMN fumbles in regards to integrating newly acquired and existing business segments for a grand total of $320MM in charges since 2006. IMN management is clearly a poor steward of capital. What’s worse is that shareholders experienced value destruction at the expense of exercises which would have returned cash to shareholders.

For example, after 2007 IMN ceased paying a dividend. The annual dividend returned over $20MM to investors annually. Rather than provide investors with a certain return in the form of a dividend, IMN management has used that capital to obviously overpay for businesses such as Encryptx. Another demonstration of poor capital allocation by management is its stock buyback history. From 2005-2008, IMN spent nearly $190MM to buyback shares when its stock was valued at levels ranging from 0.4-1.1x P/S and 0.8-1.6x P/B or $14-$48 per share. The average acquired share price of IMN’s treasury stock was $23.39.

Since 2008, IMN’s share price has ranged from its recent multi year low of $5.40 to about $14 (for a brief period in early 2009). More importantly, IMN’s valuation has ranged from 0.15-0.25 P/S and 0.28-0.36 P/B. So while IMN has had more than enough cash to purchase shares since that time, from 2009 on, IMN management decided to repurchase just under $10MM of stock. This exemplifies management’s history of overpaying for assets – whether it’s businesses, IP, or the company’s own shares.

Management has no meaningful investment in IMN: There has been considerable insider purchases since July 2011 across a number of companies. IMN has had no major inside purchases despite the current low share price. IMN CEO made an immaterial purchase in the open market very recently but overall, while IMN stock has floundered, management has experienced none of the setbacks of shareholders for its inept strategy. As mentioned above, management had the company execute on a number of buybacks from 2005-2008. However, the overall effect of those buybacks were considerably offset by significant issuance of stock compensation. As a result, IMN’s overall share count continued to grow despite these share buybacks. In summary, management has demonstrated little appetite for the company’s shares, irrespective of valuation, while expecting shareholders to sit idly by while it awards itself dilutive stock compensation off the backs of investors.

There is no question that IMN has its share of challenges but is there value to be unlocked? At current valuations, it appears that significant upside is potentially available if IMN investors can take an activist stance. Management has had its chances for many years and it is clearly time to explore other options. Despite the secular challenges IMN faces, the company is still worth more than current prices. The following highlights the good aspects of IMN.

Valuation: IMN is cheap based on a number of valuation metrics. First, at $5.81 per share as of Monday’s (11/28/11) market close, IMN has a negative enterprise value. IMN has $6.21 in net cash per share and the current share price means that the market is ascribing a negative value to IMN’s core operating business. Given the number of patents and intellectual property along with a business that can generally crank out solid cash flow, IMN’s main businesses should not have a negative value despite the longer term secular challenges it faces. On a capital return basis, IMN management should have the company repurchase shares at this level but that may be expecting far too much from management given its track record.

IMN is also trading at valuation levels below those reached even in 2008-09. As Table II shows, IMN has not traded at levels this low at least since 2003. Long-term challenges in its core business segments along with value destroying management are two reasons for these metrics grinding lower but at a certain point, valuation can become rather compelling. I think current prices and valuation may reflect “highly compelling” from an investment standpoint.

TABLE II: IMN HISTORICAL VALUATION [Click to expand]

IMN’s current valuation could be ascribed to a company with major near-term problems, typical of those that burn considerable cash and have poor balance sheets characterized by high levels of debt and/or near-term refinancings. IMN does not fit into this description. As bad as IMN is performing, it is still on track for a positive free cash flow in 2011. IMN has modest capital expenditure needs and IMN’s gross margins have been increasing in 2011, approaching gross margins realized in 2007. Table III presents my estimate for FY 2011 excluding IMN’s non-cash restructuring charges and write-offs. To be clear, a potential acquirer would also use pro forma statements in determining IMN’s value.

TABLE III: IMN 2011 SUMMARY OPERATING DATA

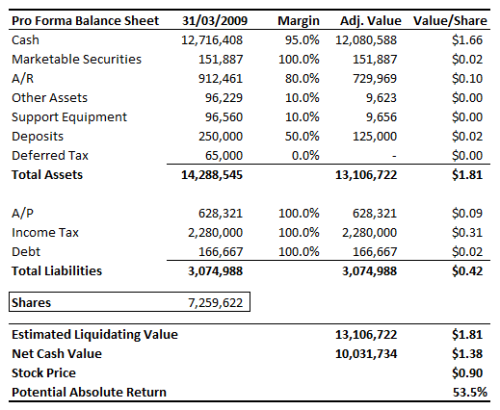

Using a highly conservative multiple of just 3.0x 2011 pro forma EBITDA of $49MM leads to a share price of $10. What is clear from Table III is that if management could avoid squandering capital on acquisitions, IMN can still generate attractive free cash flow. In addition, with a net cash balance of $233MM or $6.21/share, IMN should not generally be paying any net interest expense if that capital was better managed/allocated for cash management purposes. A history of poor capital allocation and strategic blunders has led to IMN carrying a heavily discounted valuation. At about $5.80, a case could be made that IMN is trading at or below liquidation value as presented in Table IV.

TABLE IV: IMN LIQUIDATION VALUE PER SHARE

Table IV shows that the major wildcard is really the value of IMN’s intangible assets. While IMN is facing secular challenges, the IP it carries could very well have value to a potential acquirer, especially at an attractive valuation. IMN maintains a long-term exclusive license with TDK which expires in 2032. TDK, which owns nearly 20% of IMN, could bless a sale that allows those licenses to pass on to an acquiring company. Aside from the TDK license, IMN holds over 275 patents. IMN has recently entered into security focused technology for the purposes of flash and hard drive storage. This technology uses various advanced password/encryption technology along with biometric authentication and could very well be worth much more to a larger technology company that could more broadly exploit this IP across its technology. This is just one example of various IP IMN possesses. In addition, IMN has leading market share and brand recognition/value in a number of areas such as optical media along with magnetic tape media. A competitor like Sony Corp (“SNE”) or a client like IBM or Oracle (“ORCL”), both of which use IMN’s magnetic tape media in their own products for disaster storage/recovery and archiving, could find IMN’s IP of value.

TABLE V: IMN LIQUIDATION VALUE BASED ON INTANGIBLE ASSET DISCOUNT

If IMN’s IP and thus its intangible assets are absolutely worthless, IMN would be worth under $2 in a fire sale liquidation. However, at even a 50% haircut of IP, IMN gets to where its stock is currently trading. The less severe the discount, the more IMN is worth in a liquidation. That’s hardly a groundbreaking statement but what if IMN’s IP is actually worth more than its carrying value?

TABLE VI: IMN LIQUIDATION VALUE BASED ON INTANGIBLE ASSET PREMIUM

What is clear is that IP has considerable value and in many cases eclipses the actual on-going business value of a number of companies. The recent lawsuit between Micron Technology (“MU”) and Rambus Inc (“RMBS”) was for IP claims that could have yielded nearly $4B in royalties (before potentially tripling under California law) for RMBS. RMBS commanded a market valuation of roughly$2B before MU won the lawsuit.

Motorola Mobility Holdings (“MMI”) faced very challenging headwinds in the mobile device space against tough competitors such as Apple (“AAPL”), Samsung, HTC, and others. This was reflected in the stock losing significant value once being spun off from Motorola (about 25% from its initial spin-off price). Nonetheless, Google (“GOOG”) saw value in MMI’s IP, enough to offer a share price that was essentially 100% above its at-the-time lows.

Eastman Kodak (“EK”) has a number of operating challenges and a far less attractive balance sheet relative to RMBS, MMI, and IMN. The company is wracking up losses and has a $1.2B pension shortfall. Nonetheless, IP specialists MDB Capital believe that EK’s IP could be worth $3B in a sale. EK currently has a market capitalization of just $295MM.

What is clear is that there is a wide range of valuation outcomes dependent on the value of the IP to a potential buyer. IMN could be an easy and accretive acquisition to a number of large technology firms. Firms like SNE, Maxell, and Verbatim could find IMN attractive for its leading position in optical media. SNE could also find IMN’s magnetic storage division of value, as could IBM and ORCL. IMN’s emerging storage division encompasses USB, hard disk drives, and flash drives (admittedly not really “emerging”) but has a particular focus on security focused applications in this storage format. The IP related to biometric authentication and advanced encryption could be of value to a number of storage/storage tech companies such as Western Digital Corp (“WDC”), Seagate Technology (“STX”), SanDisk Corp. (“SNDK”), Micron Technology (“MU”). Even larger enterprise storage and software companies such EMC Corp (“EMC”), IBM, and ORCL could find this segment of value. The small consumer electronics segment could be of interest to a company like Audiovox (“VOXX”). However, in any case, all of IMN could be acquired at a very attractive price to nearly any large technology firm/buyer.

At a takeout price of just $10 per share, for example, an acquirer would be buying IMN’s core business for just $142MM with $6.21 of the $10 offer represented by IMN’s net cash. This small deal size could very well lead to a quick payback period for a number of larger firms that could exploit IMN’s IP across multiple channels. IMN could also be sold off in piecemeal fashion but given its small size and number of large technology companies that can utilize IMN’s IP, folding the entire company at an attractive price could be the easiest road.

Management and the board have had more than enough time in recent years to transform IMN or move it forward. The operating results clearly show that this strategy is costing shareholders greatly and management appears to have little competence with regards to understanding how best to deploy capital. Nearly $200MM was spent to repurchase far more expensive IMN shares prior to 2008 while a pittance of IMN capital has been deployed to buyback shares when the stock is trading for less than its net cash value. In addition, upon ceasing its payment of annual dividend, IMN management has utilized that cash to pursue questionable acquisitions. These acquisitions have led to destruction of shareholder equity given the subsequent writedowns and constant restructuring charges experienced by IMN. The bottom line is IMN investors should pursue an activist stance and encourage management and the board to seek a sale for the sake of preserving what value is left in the company.

DISCLOSURE: AUTHOR MANAGES A HEDGE FUND AND MANAGED ACCOUNTS LONG IMN AND MU.

Greenbackd Disclosure: No Position.

Off-balance sheet arrangements and contractual obligations: The company hasn’t disclosed any off-balance sheet arrangements in its most recent 10Q.

Off-balance sheet arrangements and contractual obligations: The company hasn’t disclosed any off-balance sheet arrangements in its most recent 10Q.

Comments on Valuation:

Comments on Valuation: