ValueVision Media Inc. (NASDAQ:VVTV) is exactly the kind of opportunity we like to find: a net net stock with a management taking active steps to rectify the situation. At yesterday’s close of $0.44, VVTV has a market capitalization of $14.8M, which is half its net current asset value of around $29.5M, or $0.88 per share and 20% of our estimate of its value in liquidation of around $74.8M or $2.23 per share. After receiving some full and frank advice criticism on an August earnings call, VVTV’s board of directors has publicly announced that it has appointed a special committee of independent directors to “review strategic alternatives to maximize stockholder value.” The company is currently conducting an auction expected to close in February 2009. The auction has uncovered a number of interested bidders, including GE Capital Equity Investments (most recent 13D filing here), which owns 13.7% of the company. Activist investor Carlo Cannell of Cannell Capital LLC has disclosed an interest in the company and has also sent a number of entertaining letters to the CEO (which we’ve reproduced below).

About VVTV

According to its website, VVTV is a direct marketing company that markets, sells and distributes products directly to consumers through various forms of electronic media and direct-to-consumer mailings. The company’s principal electronic media activity is the television home shopping business, which uses on-air spokespersons to market brand name merchandise and private label consumer products at competitive prices. A live around the clock television home shopping programming is distributed primarily through cable and satellite affiliation agreements and the purchase of month-to-month full- and part-time lease agreements of cable and broadcast television time. In addition, ValueVision Media distributes its programming through a television station in Boston, Massachusetts. It also markets and sells an array of merchandise through http://www.shopnbc.com and http://www.shopnbc.tv.

The value proposition

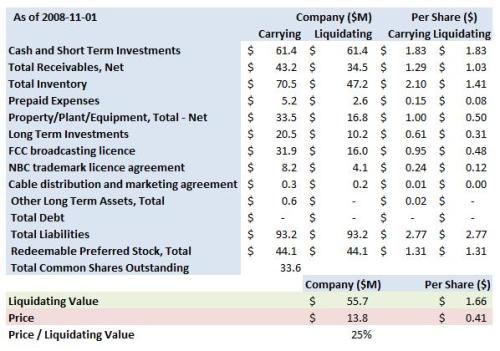

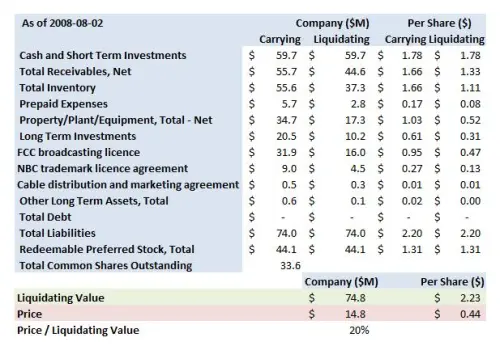

According to its most recent 10Q, VVTV lost $15.7M in the August quarter, which continues a string of five quarterly losses. Operating cash flow has also turned negative for the August quarter, which is particularly concerning. The company does have value on the balance sheet, however, as our summary analysis demonstrates (the “Carrying” column shows the assets as they are carried in the financial statements, and the “Liquidating” column shows our estimate of the value of the assets in a liquidation):

With $59.7M in cash and equivalents, $55.7M in receivables and $55.6M in inventory, VVTV’s is trading at a substantial discount to its current assets alone. The company has $1.78 per share in cash. We’ve discounted the receivables by 20% to $44.6M or $1.33 per share and the inventory by a third to $37.3M or $1.11 per share. Subtracting all liabilities of $74M or $2.20 per share and the preferred stock of $44.1M or $1.31 per share gives us a net current asset value for VVTV of around $29.5M or $0.88 per share. At yesterday’s closing price of $0.44, VVTV is trading at a 50% discount to its net current asset value alone.

VVTV has other valuable assets, including substantial property, its FCC broadcasting licence, its NBC trademark licence agreement and its Cable distribution and marketing agreement. We have no idea how to value these assets, but discounted by an arbitrary 50%, they are worth an additional $45.3M or $1.35 per share. This puts our estimate of the company’s liquidating value at around $74.8M or $2.23 per share, which means that VVTV is trading at 20% of its value in liquidation.

Carlo Cannell suggested in the October 27 letter to the CEO (reproduced below) that VVTV’s value is much higher. He thinks the company is “worth closer to $6.00 per share, exclusive of the $120 million net operating loss and substantial intangible value in the broad 72 million reach enjoyed by ShopNBC.” Cannell’s analysis is as follows (all figures are $/share figures):

Net Working Capital – $3.73 (Includes $2.39/share in Cash. Excludes NOL and value of Shop NBC.)

Headquarters – $1.03

Television Station – $0.95

NBC License Agreement – $0.27

Total Asset Value – $5.98

VVTV is trading at less than 7% of Cannell’s valuation.

The catalyst

VVTV’s stock is down about 91% ($5.53 per share) this year. During VVTV’s second-quarter conference call in August, shareholders lambasted management and called for the sale of the company. As a result, VVTV disclosed in its 10Q that it was pursuing “strategic alternatives”:

On September 11, 2008, our board of directors announced that it had appointed a special committee of independent directors to review strategic alternatives to maximize stockholder value. The committee currently consists of two directors: George Vandeman, who will serve as the committee’s chairman, and Robert Korkowski. We expect to appoint an additional independent director to the board, who we anticipate will serve on the special committee. The special committee retained Piper Jaffray & Co., a nationally-recognized investment banking firm, as its financial advisor. There can be no assurance that the review process will result in the announcement or consummation of a sale of our company or any other strategic alternative. We do not intend to comment publicly with respect to any potential strategic alternatives we may consider pursuing unless or until a specific alternative is approved by our board of directors.

On September 24, 2008 Cannell Capital amended an earlier 13G filing for VVTV in this 13D filing, annexing an entertaining letter from Carlo Cannell to Mr. John Buck, VVTV’s CEO (reproduced below):

Dear Mr. Buck

Cannell Capital LLC (“Cannell”), an investment adviser and General Partner to several private investment funds and partnerships, which own shares in ValueVision Media Inc. (“VVTV”), is amending its reporting requirements to reflect a more active stance.

Congratulations on your September 11, 2008 decision to appoint “a special committee of independent directors to review strategic alternatives to maximize shareholder value.” Cannell interprets this to mean that the representatives of the shareholders (aka “Directors”) have finally elected to monetize the assets on behalf of its owners.

ValueVision’s stock price is $2.20 per share. Based upon analysis our from Craig-Hallum it is our opinion the company is worth closer to $6.00 per share, exclusive of the $120 million net operating loss and substantial intangible value in the broad 72 million reach enjoyed by ShopNBC.(1)

$/Share

-------

Net Working Capital* $3.73

Headquarters $1.03

Television Station $0.95

NBC License Agreement $0.27

Total Asset Value $5.98

*Includes $2.39/share in Cash. Excludes NOL

and value of Shop NBC.

We will be watching carefully to make sure the committee’s actions are congruent with the interests of shareholders. We are concerned that the hiring of Piper Jaffray & Co. may be a ploy to continue to justify its pattern of wheel spinning and protection of jobs over what is best for the owners of the business. For example, on Monday, September 15, 2008 we were shocked to learn that your agent (Piper Jaffray & Co.) called to “permission” when and to whom we might talk at our Company. This is characteristic of Stalinist Russia, not America. This does not have a good taint to it. You may try to muzzle other investors, but not Cannell. It bites.

You further have called for representatives to the Board of Directors. We have several candidates in mind. Two will be contacting you shortly to present their credentials directly.

It is amazing to us how much value has been destroyed under your stewardship. That you would have to hire an agent at all to advise you on what should have been done long ago is shameful.

Godspeed!

J. Carlo Cannell

Managing Member

Cannell Capital LLC

————————-

(1) Robert J. Evans, Craig-Hallum Capital Group, 8/25/08

Cannell sent a follow up letter on October 27, 2008, which was annexed to this 13D filing and is reproduced below:

Dear Mr. Buck

Thank you for taking the time to speak with us this month. I imagine that you are busy consulting with sundry advisors as to ways to maximize shareholder value, including, but not limited to the immediate liquidation of our assets.

Regrettably, at this rate there will not be much value to realize. The price of the common stock has declined 65% this month alone.

I am sorry that you feel the name of the broker hired to sell our buildings at 6740, 6680 and 6690 Shady Oak Road, Eden Prairie, MN 55334 to be material non-public information. I disagree.

Given the slope of shareholder wealth destruction and given the inconsistency of information delivered to us by sundry directors and officers of our Company I would like to suggest that you deliver a special dividend of $1.20 per share to its owners, the shareholders.(1) Although I can’t speak for all shareholders, it is my opinion that most would see copious opportunities to allocate their capital to other stewards of this capital than that of the current board of VVTV.

If the board agrees with me, please tell me by Halloween when my investors and other shareholders might get their dividend. (Time is of the essence. If Senator Barack Obama is elected President the taxation of dividends is likely to become less favorable.) If you disagree, please state the reasons behind your opposition.

In the case of the latter outcome, Cannell Capital LLC will review your opposition and, if appropriate, we will evaluate our options in calling a special meeting of all shareholders to vote upon whether: (i) our cash should be returned to its owners or (ii) the existing board should be allowed to continue to manage it.

Best regards!

Sincerely

J. Carlo Cannell

Managing Member

————————-

(1) As of August 2, 2008, VVTV had $79.4 million of cash – $48.8 million of liquid, $10.9 million of short term equivalent and $20.5 million of auction rate securities (which should likely be discounted by $1.5 million). That is $2.36 per share. I like the idea that returning this cash is tax efficient and will deter management from performing more “science projects.” More pressure is good in my opinion.

On a conference call with analysts to discuss VVTV’s third quarter results, Mr. George Vandeman, who is chairman of VVTV’s special committee of independent directors, said the company had received bids from a number of companies and instructed its advisers to invite several of the proposed buyers to take part in the next phase of the process. Final bids would be due after that phase is completed. One of those interested bidders is GE Capital Equity Investments, which disclosed its holding in this November 17, 2008 13D filing. Vandeman also said the committee was “evaluating other alternatives to boost value, including share buybacks, paying a dividend and monetizing its balance sheet.”

The special committee and its financial advisors continue to review the full range of strategic alternatives available to the company. We anticipate that the special committee will conclude its review by the end of the fiscal year.

VVTV’s fiscal year ends February 2. These are all promising developments for VVTV.

Conclusion

This seems to us to be one of the better opportunities available in the present market. VVTV, a net net stock with additional valuable assets, is very cheap. At yesterday’s close of $0.44, VVTV has a market capitalization of $14.8M, which is half its net current asset value of around $29.5M, or $0.88 per share. Including the other assets – its property, FCC broadcasting licence, NBC trademark licence agreement and the Cable distribution and marketing agreement – we estimate VVTV is worth closer to $2.23 per share. Cannell Capital sees the value as high as $5.98 per share. The company also seems to be taking steps to realise that value, publicly announcing that it has appointed a special committee of independent directors to “review strategic alternatives to maximize stockholder value.” Currently, that means that the company is conducting an auction with a number of interested bidders but it may also mean the company buys back shares, pays a dividend or monetizes its balance sheet. The committee expect to complete this process by February 2, 2009, which means that this opportunity won’t be around for much longer.

VVTV closed yesterday at $0.44.

The S&P 500 Index closed at 888.67.

[Disclosure: We have a holding in VVTV. This is neither a recommendation to buy or sell any securities. All information provided believed to be reliable and presented for information purposes only.]

Read Full Post »