In Fat Tails: How The Equity Q Ratio Anticipates Stock Market Crashes and The Equity Q Ratio: How Overvaluation Leads To Low Returns and Extreme Losses I examined Universa Chief Investment Officer Mark Spitznagel’s June 2011 working paper The Dao of Corporate Finance, Q Ratios, and Stock Market Crashes (.pdf), and the May 2012 update The Austrians and the Swan: Birds of a Different Feather (.pdf), which discuss the “clear and rigorous evidence of a direct relationship“between overvaluation measured by the equity q ratio and “subsequent extreme losses in the stock market.”

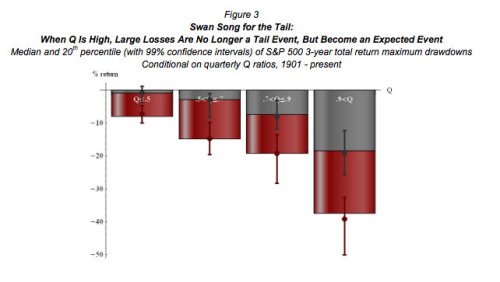

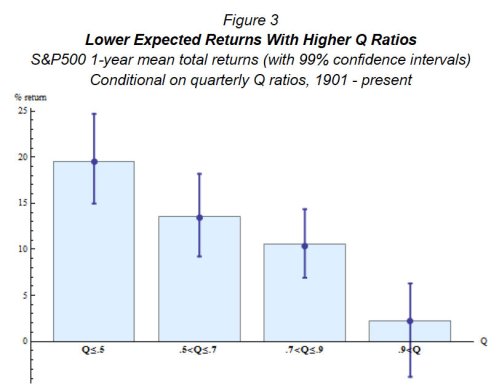

Spitznagel argues that at valuations where the equity q ratio exceeds 0.9, the 110-year relationship points to an “expected (median) drawdown of 20%, and a 20% chance of a larger than 40% correction in the S&P500 within the next few years; these probabilities continually reset as valuations remain elevated, making an eventual deep drawdown from current levels highly likely.”

So where are we now?

Smithers & Co. tracks the equity q ratio for the US. The chart below shows each to its own average on a log scale.

According to Smithers & Co., the equity q ratio currently stands at 1.05, which is some 17 percent above 0.9, the ratio at which “an “expected (median) drawdown of 20%, and a 20% chance of a larger than 40% correction in the S&P500 within the next few years.” Smithers & Co. note:

Both q and CAPE include data for the year ending 31st December, 2012. At that date the S&P 500 was at 1426 and US non-financials were overvalued by 44% according to q and quoted shares, including financials, were overvalued by 52% according to CAPE. (It should be noted that we use geometric rather than arithmetic means in our calculations.)

As at 12th March, 2013 with the S&P 500 at 1552 the overvaluation by the relevant measures was 57% for non-financials and 65% for quoted shares.

Although the overvaluation of the stock market is well short of the extremes reached at the year ends of 1929 and 1999, it has reached the other previous peaks of 1906, 1936 and 1968.

Like the Shiller PE and Buffett’s total market capitalization-to-gross national product measure, the equity q ratio is a poor short-term market timing device. This is because there are no reliable short-term market timing devices. If one existed, its effect would be rapidly arbitraged away. So why look market-level valuation measures? From Smithers & Co.:

Understanding value is vital for investors.

(i) It provides a sound way of assessing the probable returns over the medium-term.

(ii) It provides information about the current risks of stock market investment.

(iii) It enables investors to avoid nonsense claims about value.

Extreme discipline is required at market extremes. Gladwell’s profile of Taleb, Blowing Up, shows how difficult such periods can be:

Empirica has done nothing but lose money since last April. “We cannot blow up, we can only bleed to death,” Taleb says, and bleeding to death, absorbing the pain of steady losses, is precisely what human beings are hardwired to avoid. “Say you’ve got a guy who is long on Russian bonds,” Savery says. “He’s making money every day. One day, lightning strikes and he loses five times what he made. Still, on three hundred and sixty-four out of three hundred and sixty-five days he was very happily making money. It’s much harder to be the other guy, the guy losing money three hundred and sixty-four days out of three hundred and sixty-five, because you start questioning yourself. Am I ever going to make it back? Am I really right? What if it takes ten years? Will I even be sane ten years from now?” What the normal trader gets from his daily winnings is feedback, the pleasing illusion of progress. At Empirica, there is no feedback. “It’s like you’re playing the piano for ten years and you still can’t play chopsticks,” Spitznagel say, “and the only thing you have to keep you going is the belief that one day you’ll wake up and play like Rachmaninoff.”

Finally, even though we can plainly see that markets are presently overvalued on several measures, we can’t know when a sell-off will occur. All we can say is that returns are likely to be sub-par for an extended period, and that the probabilities are quite high that a substantial drawdown will occur in the next two to three years. One thing that we can be sure of, is that when it does occur, the catalyst that ostensibly triggers the sell off will be treated as a black swan, even though the real cause is massive overvaluation. From the perspective of behavioral investment, this story of Gladwell’s is interesting:

In the summer of 1997, Taleb predicted that hedge funds like Long Term Capital Management were headed for trouble, because they did not understand this notion of fat tails. Just a year later, L.T.C.M. sold an extraordinary number of options, because its computer models told it that the markets ought to be calming down. And what happened? The Russian government defaulted on its bonds; the markets went crazy; and in a matter of weeks L.T.C.M. was finished. Spitznagel, Taleb’s head trader, says that he recently heard one of the former top executives of L.T.C.M. give a lecture in which he defended the gamble that the fund had made. “What he said was, Look, when I drive home every night in the fall I see all these leaves scattered around the base of the trees,?” Spitznagel recounts. “There is a statistical distribution that governs the way they fall, and I can be pretty accurate in figuring out what that distribution is going to be. But one day I came home and the leaves were in little piles. Does that falsify my theory that there are statistical rules governing how leaves fall? No. It was a man-made event.” In other words, the Russians, by defaulting on their bonds, did something that they were not supposed to do, a once-in-a-lifetime, rule-breaking event. But this, to Taleb, is just the point: in the markets, unlike in the physical universe, the rules of the game can be changed. Central banks can decide to default on government-backed securities.

US equity markets are very overvalued on a variety of measures. If Spitznagel’s thesis is correct that the frequency and magnitude of tail events increases with overvaluation, investors need to exercise caution given the extreme level of the equity q ratio. If the eventual event precipitating a sell off is a black swan, but we can expect black swans because of the market’s overvaluation, is it still a black swan?

Order Quantitative Value from Wiley Finance, Amazon, or Barnes and Noble.

Click here if you’d like to read more on Quantitative Value, or connect with me on LinkedIn.