In March I highlighted an investment strategy I first read about in a Spring 1999 research report called Wall Street’s Endangered Species by Daniel J. Donoghue, Michael R. Murphy and Mark Buckley, then at Piper Jaffray and now at Discovery Group, a firm founded by Donoghue and Murphy (see also Performance of Darwin’s Darlings). The premise, simply stated, is to identify undervalued small capitalization stocks lacking a competitive auction for their shares where a catalyst in the form of a merger or buy-out might emerge to close the value gap. I believe the strategy is a natural extension for Greenbackd, and so I’ve been exploring it over the last month.

Donoghue, Murphy and Buckley followed up their initial Wall Street’s Endangered Species research report with two updates, which I recalled were each called “Endangered Species Update” and discussed the returns from the strategy. While I initially believed that those follow-up reports were lost to the sands of time, I’ve been excavating my hard-copy files and found them, yellowed, and printed on papyrus with a dot matrix 9-pin stylus. I’ve now resurrected both, and I’ll be running them today and tomorrow.

In the first follow-up, Endangered species update: The extinct, the survivors, and the new watch list (.pdf), from Summer 2000, Murphy and Buckley (Donoghue is not listed on the 2000 paper as an author) tested their original thesis and provided the “Darwin’s Darlings Class of 2000,” which was a list of what they viewed as “the most undervalued, yet profitable and growing small cap public companies” in 2000.

As for the original class of 1999, the authors concluded:

About half of the Darwin’s Darlings pursued some significant strategic alternative during the year. A significant percentage (19 of the companies) pursued a sale or going-private transaction to provide immediate value to their shareholders. Others are attempting to “grow out of” their predicament by pursuing acquisitions, and many are repurchasing shares. However, about half of the Darlings have yet to take any significant action. Presumably, these companies are ignoring their current share price and assuming that patient shareholders will eventually be rewarded through a reversal in institutional investing trends or, more likely, a liquidity event at some later date. The path chosen clearly had a significant impact on shareholder value.

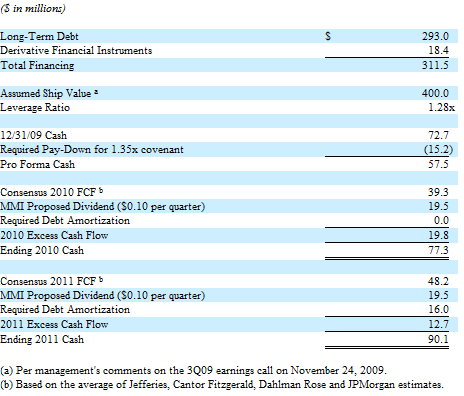

Here’s the summary table:

There are several fascinating aspects to their analysis. First, they looked at the outstanding performance of the sellers:

The 19 companies that pursued a sale easily outperformed the Russell 2000 and achieved an average premium of 51.4% to their 4-week prior share price. The vast majority of transactions were sales to strategic buyers who were able to pay a handsome premium to the selling shareholders. In general, the acquirers were large cap public companies. By simply valuing the profits of a Darwin’s Darling at their own market multiple, these buyers delivered a valuation to selling shareholders that far exceeded any share price the company might have independently achieved. Note in the summary statistics below that the average deal was at an EBIT multiple greater than 10x.

Here’s the table:

Second, they considered the low proportion of sellers who went private, rather than sold out to a strategic acquirer, and likely causes:

Second, they considered the low proportion of sellers who went private, rather than sold out to a strategic acquirer, and likely causes:

Only three of the Darwin’s Darlings announced a going-private transaction. At first glance, this is a surprisingly small number given the group’s low trading multiples and ample debt capacity. With private equity firms expressing a very high level of interest in these transactions, one might have expected more activity.

…

Why isn’t the percentage higher? In our opinion, it is a mix of economic reality and an ironic impact of corporate governance requirements. The financial sponsors typically involved in taking a company private are constrained with respect to the price they can pay for a company. With limits on prudent debt levels and minimum hurdle rates for equity investments, the typical financial engineer quickly reaches a limit on the price he can pay for a company. As a result, several factors come into play:

• A Board will typically assume that if a “financial” buyer is willing to pay a certain price, a “strategic” buyer must exist that can pay more.

• Corporate governance rules are usually interpreted to mean that a Board must pursue the highest price possible if a transaction is being evaluated.

• Management is reluctant to initiate a going-private opportunity for fear of putting the Company “in play.”

• Financial buyers and management worry that an unwanted, strategic “interloper” can steal a transaction away from them when the Board fulfills its fiduciary duty.

In light of the final two considerations, which benefit only management, it’s not difficult to understand why activists considered this sector of the market ripe for picking, but I digress.

Third, they analyzed the performance of companies repurchasing shares:

To many of the Darwin’s Darlings, their undervaluation was perceived as a buying opportunity. Twenty companies announced a share repurchase, either through the open market, or through more formalized programs such as Dutch Auction tender offers (see our M&A Insights: “What About a Dutch Auction?” April 2000).

As we expected, these repurchases had little to no impact on the companies’ share prices. The signaling impact of their announcement was minimal, since few analysts or investors were listening, and the buying support to the share price was typically insignificant. Furthermore, the decrease in shares outstanding served only to exacerbate trading liquidity challenges. From announcement date to present, these 20 companies as a group have underperformed the Russell 2000 by 17.5%.

For many of the Darlings and other small cap companies the share repurchase may still have been an astute move. While share prices may not have increased, the ownership of the company was consolidated as a result of buying-in shares. ‘The remaining shareholders were, in effect, “accreted up” in their percentage ownership. When a future event occurs to unlock value, these shareholders should reap the benefit of the repurchase program. Furthermore, the Company may have accommodated sellers desiring to exit their investment, thereby eliminating potentially troublesome, dissenting shareholders.

One such company repurchasing shares will be familiar to anyone who has followed Greenbackd for a while: Chromcraft Revington, Inc., (CRC:AMEX), which I entered as a sickly net net and exited right before it went up five-fold. (It’s worth noting that Jon Heller of Cheap Stocks got CRC right, buying just after I sold and making out like a bandit. I guess you can’t win ’em all.) Murphy and Buckley cite CRC as an abject lesson in why buy-backs don’t work for Darwin’s Darlings:

I’m not entirely sure that the broader conclusion is a fair one. Companies shouldn’t repurchase shares to goose share prices, but to enhance underlying intrinsic value in the hands of the remaining shareholders. That said, in CRC’s case, the fact that it went on to raise capital at a share price of ~$0.50 in 2009 probably means that their conclusion in CRC’s case was the correct one.

I’m not entirely sure that the broader conclusion is a fair one. Companies shouldn’t repurchase shares to goose share prices, but to enhance underlying intrinsic value in the hands of the remaining shareholders. That said, in CRC’s case, the fact that it went on to raise capital at a share price of ~$0.50 in 2009 probably means that their conclusion in CRC’s case was the correct one.

And what of the remainder:

About half of the Darwin’s Darlings stayed the course and did not announce any significant event over the past year. Another 18 sought and consummated an acquisition of some significant size. While surely these acquisitions had several strategic reasons, they were presumably pursued in part to help these companies grow out of their small cap valuation problems. Larger firms will, in theory, gain more recognition, additional liquidity, and higher valuations. However, for both the acquirers and the firms without any deal activity, the result was largely the same: little benefit for shareholders was provided.

Management teams and directors of many small cap companies have viewed the last few years as an aberration in the markets. “Interest in small caps will return” is a common refrain. We disagree, and our statistics prove us right thus far. Without a major change, we believe the shares of these companies will continue to meander. For the 53 Darwin’s Darlings that did not pursue any major activity in the last year, 80% are still below their 1998 high and 60% have underperformed the Russell 2000 over the last year. These are results, keep in mind, for some of the most attractive small cap firms.

This is the fabled “two-tier” market beloved by value investors. While everyone else was chasing dot coms and large caps, small cap companies with excellent fundamentals were lying around waiting to be snapped up. The authors concluded:

The public markets continue to ignore companies with a market capitalization below $250 million. Most institutional investors have large amounts of capital to invest and manage, and small caps have become problematic due to their lack of analyst coverage and minimal public float. As a result, these “orphans” of the public markets are valued at a significant discount to the remainder of the market. We do not see this trend reversing, and therefore recommend an active approach to the directors and management teams at most small cap companies. Without serious consideration of a sale to a strategic or financial buyer, we believe these companies, despite their sound operating performance, will not be able to deliver value to their shareholders.

Tomorrow, the 2001 Endangered species update.