Continuing the quantitative value investment theme I’ve been trying to develop over the last week or so, I present my definition of a simple quantitative value strategy: net nets. James Montier, author of the essay Painting By Numbers: An Ode To Quant, which I use as the justification for simple quantitative investing, authored an article in September 2008 specifically dealing with net nets as a global investment strategy: Graham’s net-nets: outdated or outstanding? (Edit: It seems this link no longer works as SG obliterates any article ever written by Montier). Quelle surprise, Montier found that buying net-nets is a viable and profitable strategy:

Testing such a deep value approach reveals that it would have been a highly profitable strategy. Over the period 1985-2007, buying a global basket of net-nets would have generated a return of over 35% p.a. versus an equally weighted universe return of 17% p.a.

An annual return of 35% over 23 years would put you in elite company indeed, so Montier’s methodology is worthy of closer inspection. Unfortunately he doesn’t discuss his methodology in any detail, other than to say as follows:

I decided to test the performance of buying net-nets on a global basis. I used a sample of developed markets over the period 1985 onwards, all returns were in dollar terms.

It may have been a strategy similar to the annual rebalancing methodology discussed in Oppenheimer’s Ben Graham’s Net Current Asset Values: A Performance Update. That paper demonstrates a purely mechanical annual rebalancing of stocks meeting Graham’s net current asset value criterion generated a mean return between 1970 and 1983 of “29.4% per year versus 11.5% per year for the NYSE-AMEX Index.” It doesn’t really matter exactly how Montier generated his return. Whether he bought each net net as it became a net net or simply purchased a basket on a regular basis (monthly, quarterly, annually, whatever), it’s sufficient to know that he was testing the holding of a basket of net nets throughout the period 1985 to 2007.

Montier’s findings are as follows:

- The net-nets portfolio contains a median universe of 65 stocks per year.

- There is a small cap bias to the portfolio. The median market cap of a net-net is US$21m.

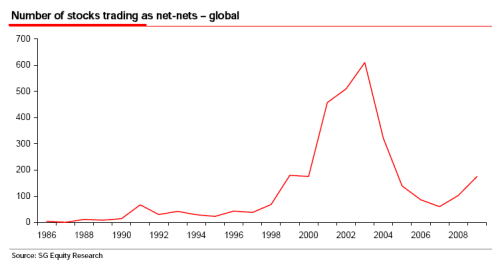

- At the time of writing (September 2008), Montier found around 175 net-nets globally. Over half were in Japan.

- If we define total business failure as stocks that drop more than 90% in a year, then the net-nets portfolio sees about 5% of its constituents witnessing such an event. In the broad market only around 2% of stocks suffer such an outcome.

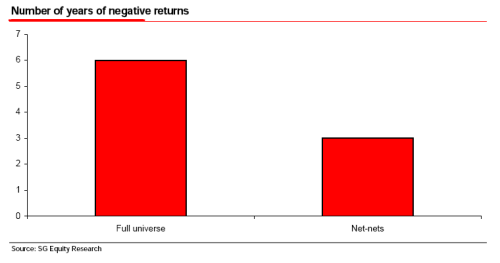

- The overall portfolio suffered only three down years in our sample, compared to six for the overall market.

Several of Montier’s findings are particularly interesting to me. At an individual company level, a net net is more likely to suffer a permanent loss of capital than the average stock:

If we define a permanent loss of capital as a decline of 90% or more in a single year, then we see 5% of the net-nets selections suffering such a fate, compared with 2% in the broader market.

Here’s the chart:

This is interesting given that NCAV is often used as a proxy for liquidation value.

Very few companies turn out to have an ultimate value less than the working capital alone, although scattered instances may be found.

Montier believes this may provide a clue as to why the net net strategy continues to work:

This relatively poor performance may hint at an explanation as to why investors shy away from net-nets. If investors look at the performance of the individual stocks in their portfolio rather than the portfolio itself (known as narrow-framing), then they will see big losses more often than if they follow a broad market strategy. We know that people are generally loss averse, so they tend to feel losses far more than gains. This asymmetric response coupled with narrow framing means that investors in the net-nets strategy need to overcome several behavioural biases.

Paradoxically, it seems that what is true at the individual company level is not true at an aggregate level. The net net strategy has fewer down years than the market:

If one were to frame more broadly and look at the portfolio performance overall, the picture is much brighter. The net-net strategy only generated losses in three years in the entire sample we backtested. In contrast, the overall market witnessed some six years of negative returns.

Here’s the chart:

And it seems that the net net strategy is a reasonable contrary indicator. When the market is up, fewer can be found, and when the market is down, they seem to be available in abundance:

The main drawback to the net net strategy is its limited application. Stocks tend to be small and illiquid, which puts a limit on the amount of capital that can be safely run using it. That aside, it seems like a good way to get started in a small fund or with a individual account. Montier concludes:

In various ways practically all these bargain issues turned out to be profitable and the average annual return proved much more remunerative than most other investments.

Good old Benjamin Graham. What a guy.

Buy my book The Acquirer’s Multiple: How the Billionaire Contrarians of Deep Value Beat the Market from on Kindle, paperback, and Audible.

Here’s your book for the fall if you’re on global Wall Street. Tobias Carlisle has hit a home run deep over left field. It’s an incredibly smart, dense, 213 pages on how to not lose money in the market. It’s your Autumn smart read. –Tom Keene, Bloomberg’s Editor-At-Large, Bloomberg Surveillance, September 9, 2014.

Click here if you’d like to read more on The Acquirer’s Multiple, or connect with me on Twitter, LinkedIn or Facebook. Check out the best deep value stocks in the largest 1000 names for free on the deep value stock screener at The Acquirer’s Multiple®.

We opened a position in VNDA and got a great return. We lost our nerve with BGP and missed out on a great return. We completely ignored ATSG, DTSG, SMRT, RFMD, PIR and CHUX although all appeared on our NCAV screen at some stage earlier this year. A little more evidence that diamonds can be found if you dig through enough trash.

We opened a position in VNDA and got a great return. We lost our nerve with BGP and missed out on a great return. We completely ignored ATSG, DTSG, SMRT, RFMD, PIR and CHUX although all appeared on our NCAV screen at some stage earlier this year. A little more evidence that diamonds can be found if you dig through enough trash.